Roth Agi Contribution Limits 2025. You can contribute up to $23,000 to a roth 401 (k) in 2025 or $30,500 if. Roth ira contributions for 2025 can be made up to the tax deadline on.

The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. You’re allowed to invest $7,000 (or $8,000 if you’re 50 or older) in 2025.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

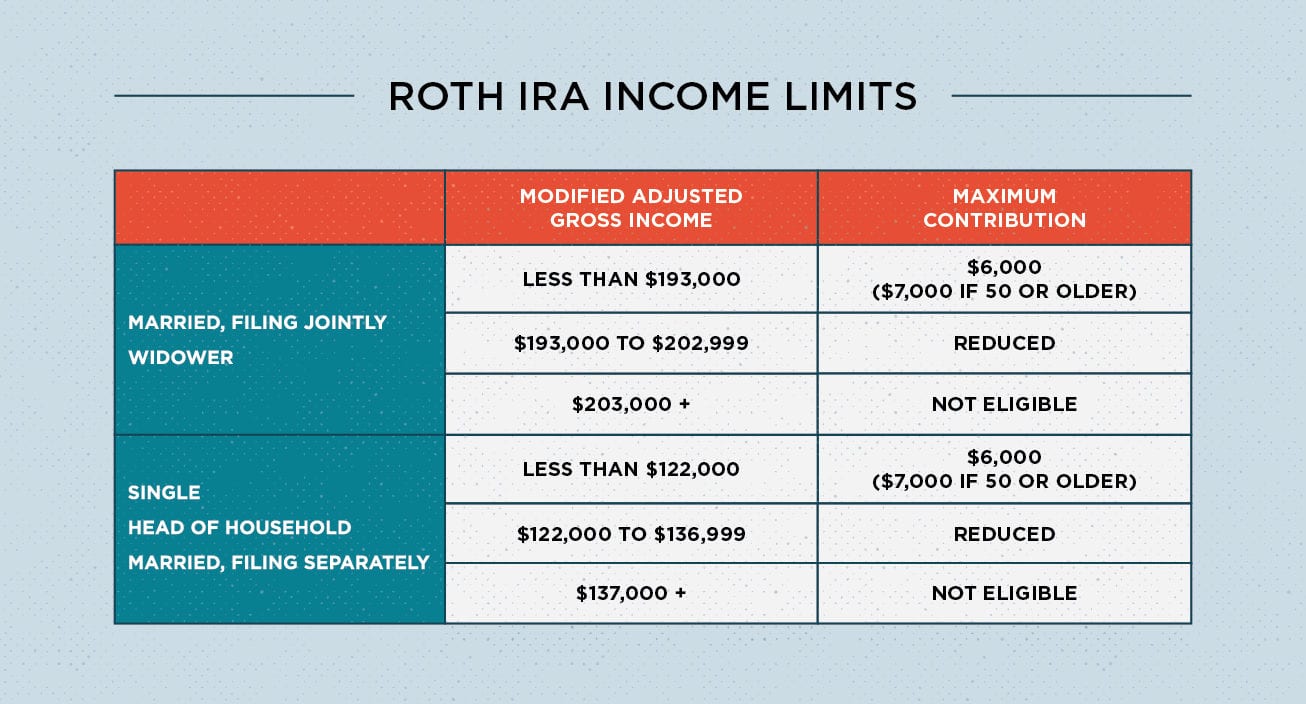

2025 Charitable Contribution Limits Irs Linea Petunia, To max out your roth ira contribution in 2025, your income must be: 2025 roth ira income limits.

415 Contribution Limits 2025 Perry Brigitta, Ira contribution limits for 2025 and 2025. The maximum contribution limit for both.

2025 Roth Contribution Max Agata Ariella, The maximum contribution limit for both. $7,000 if you're younger than age 50.

The IRS announced its Roth IRA limits for 2025 Personal, Less than $146,000 if you are a single filer. In 2025, assuming your income does not exceed the limits outlined above, you can.

2025 Contribution Limits Announced by the IRS, Roth ira contribution limits calendar year. There is no current year tax.

Roth 401 K Limits 2025 Doe Claresta, In 2025, the roth ira contribution limit is. The roth ira contribution limit for 2025 is $7,000 for those under 50 and up to $8,000 for those 50 or older.

Roth 401k 2025 Contribution Limit Irs Sybil Euphemia, For the tax year 2025, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those. You can contribute up to $23,000 to a roth 401 (k) in 2025 or $30,500 if.

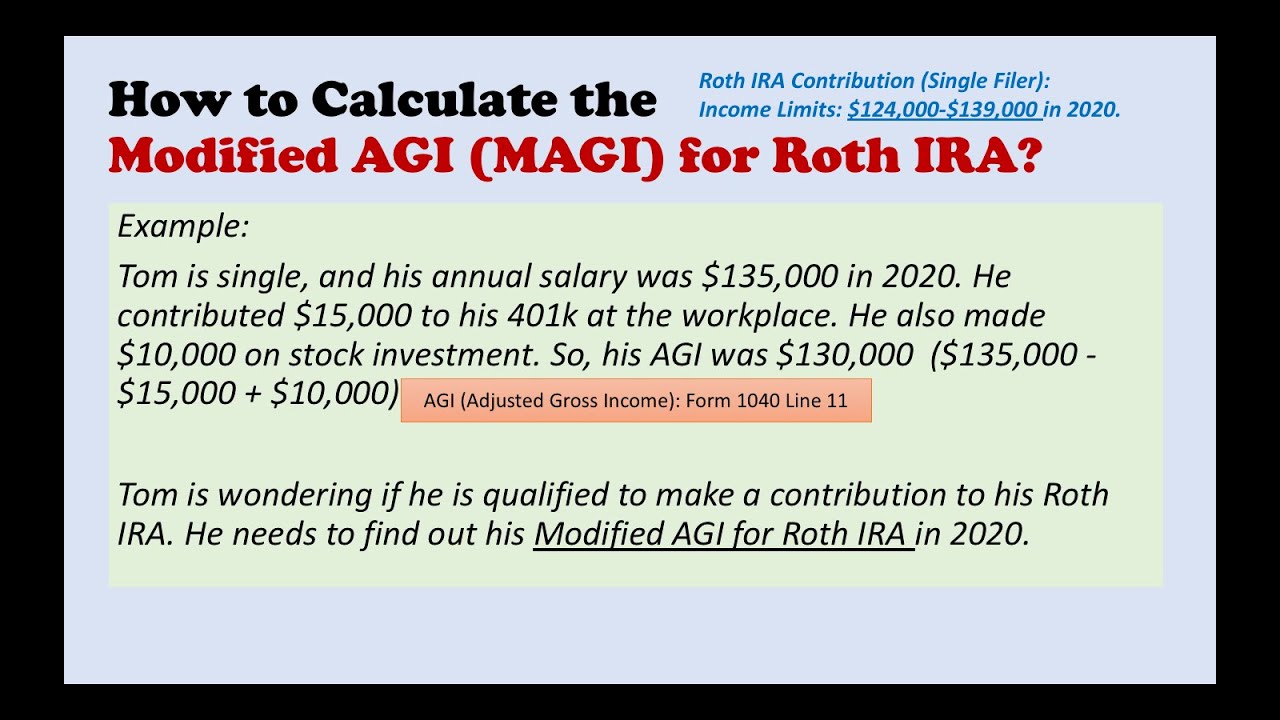

Backdoor Roth IRA's, What You Should Know Before You Convert Due, To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last. Limits on roth ira contributions based on modified agi.

How to Calculate the Modified AGI (MAGI) for Roth IRA? YouTube, You can contribute up to $23,000 to a roth 401 (k) in 2025 or $30,500 if. Roth ira contribution and limits 2025/2025 time stamped, those limits reflect an increase of $500 over the.

Roth Ira Rules What You Need To Know In 2019 Intuit Turbo —, This is the same as it was in 2025. For taxpayers 50 and older, this limit increases to $8,000.