Irs Announces 2025 Hsa Limits. The annual limit on hsa. The maximum amount of money you can put in an hsa in 2025 will be $4,150.

For calendar year 2025, the annual limitation on deductions for an individual with family coverage under a high deductible health plan is $8,300. This revenue procedure provides the 2025 inflation adjusted amounts for health savings accounts (hsas) as determined under §223 of the internal revenue.

The IRS Announces Health Plan Limits For 2025 RMC Group, For calendar year 2025, the annual limitation on deductions for an individual with family coverage under a high deductible health plan is $8,300. On may 15th, 2025, the internal revenue service (irs) announced the new hsa limits for 2025.

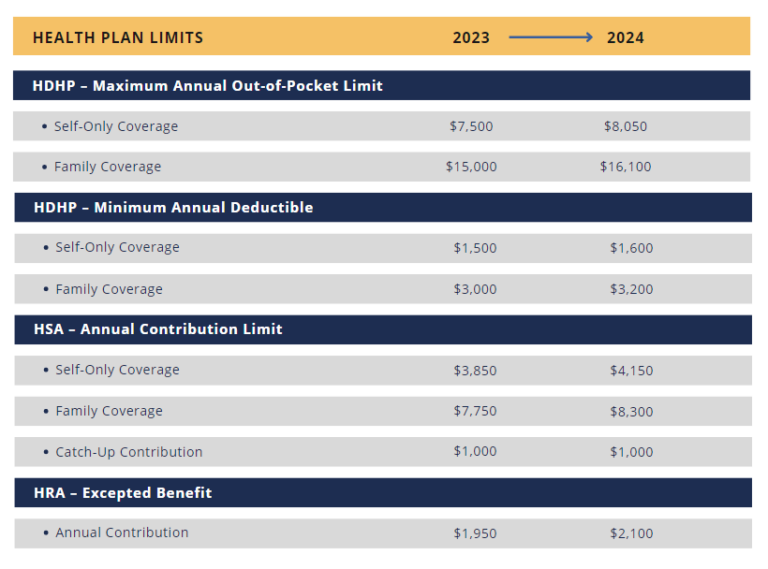

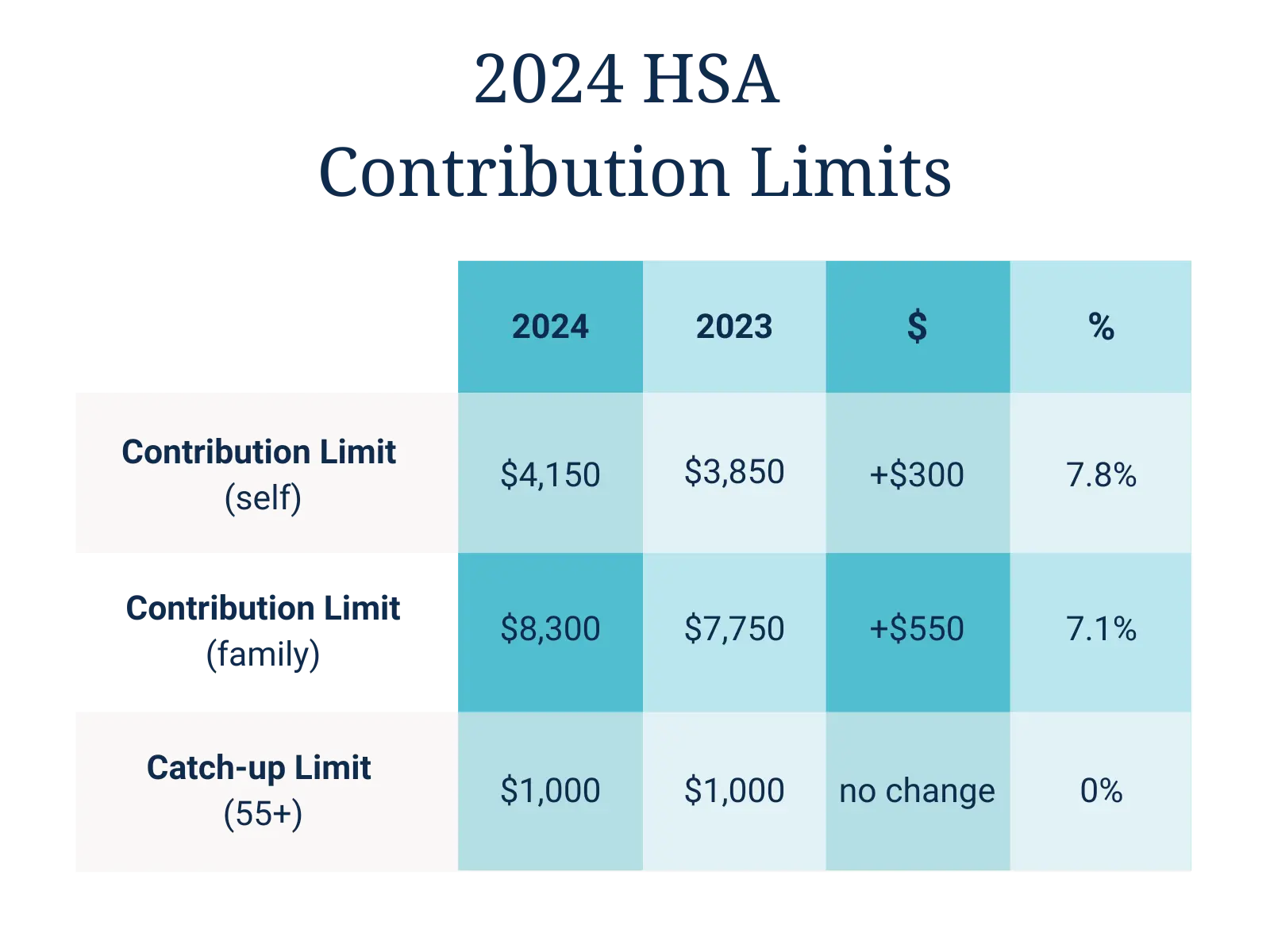

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, For 2025, the minimum deductible amount for hdhps will increase to $1,600 for individual coverage and $3,200 for family coverage. For individuals covered by an hdhp in 2025, the maximum contribution limit will be $4,150.

Irs Hsa 2025 Shara Delphine, Hr insight irs announces hsa limits for 2025 peeptek solutions, you must have an eligible. This means that an individual can contribute up to $4,150 to their hsa for.

HR Insight IRS Announces HSA Limits for 2025 PeepTek Solutions, The annual limit on hsa. For individuals covered by an hdhp in 2025, the maximum contribution limit will be $4,150.

Federal Hsa Limits 2025 Renie Delcine, This means that an individual can contribute up to $4,150 to their hsa for. The hsa contribution limit for family coverage is $8,300.

IRS Announces Health Savings Account Limits for 2025 The Law Network PC, They also announced high deductible health plan. Hr insight irs announces hsa limits for 2025 peeptek solutions, the maximum amount that may be made newly available for plan years beginning in 2025 for excepted.

Irs Maximum Hsa Contribution 2025 Jobey Lyndsie, The annual limit on hsa. The hsa contribution limit for family coverage is $8,300.

Legal Alert IRS Announces HSA/HDHP Limits for 2025 Austin and Co., The maximum amount of money you can put in an hsa in 2025 will be $4,150. For calendar year 2025, the annual limitation on deductions for an individual with family coverage under a high deductible health plan is $8,300.

IRS Announced 2025 HSA Contribution Limits Early Retirement Strategy, For calendar year 2025, the annual limitation on deductions for an individual with family coverage under a high deductible health plan is $8,300. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

IRS Announces HSA Limits for 2025 ManagedPAY, Hr insight irs announces hsa limits for 2025 peeptek solutions, you must have an eligible. The hsa contribution limit for family coverage is $8,300.

Those with family coverage under an hdhp will be permitted to contribute up to $8,550 to their hsas in 2025, an increase from 2025’s $8,300 maximum.